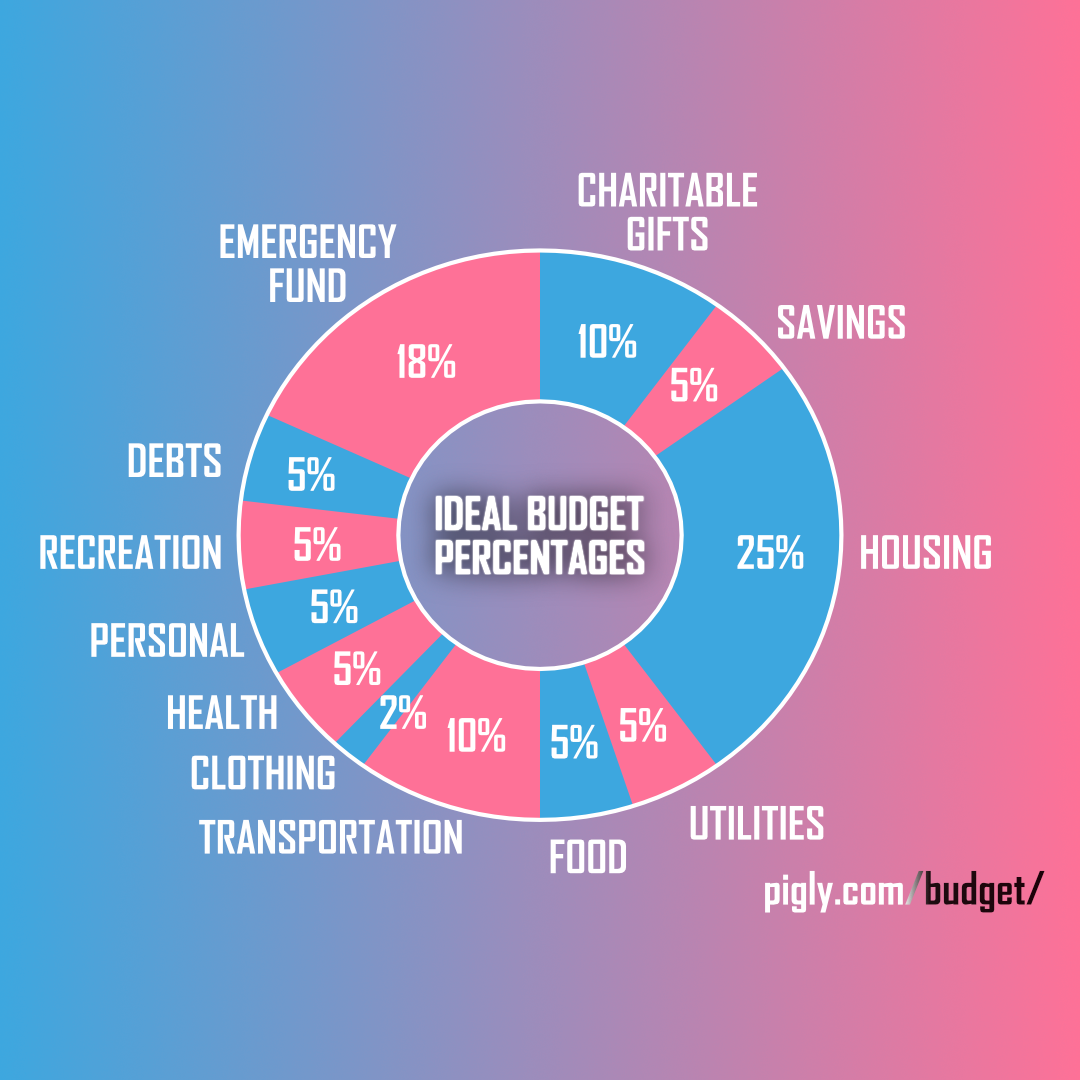

Ideal Budget Percentages + Calculator

When you receive your paycheck, have you ever wondered if there are Ideal Budget Percentages that you could try and adhere to in managing your personal finance? The above Ideal Budget Percentages Infographic shows you exactly that.

In fact, Pigly.com has a Budget Calculator [click] which gives you how much money you could allocate for which purpose, every month or year, based on ideal budget percentages. You just need to enter your total income and it will give you the amount you ought to be allocating for each category, including a variance between high-end and low-end. Check it out!

Why should you bother about Ideal Budget percentages?

The easiest thing to do is not to have a budget at all. The second easiest thing to do is not to stick to the budget. These two are the perfect recipes for a perfect disaster!

It’s human to over-spend when there is excess money on hand, and then cut costs (even on essential items) when there is not much money left.

With a personal budget, you can avoid that bad habit.

What is NOT a Budget?

A Budget is NOT about cutting costs and buying cheap. If anything, it’s the opposite.

A good budget will enable you to make the right investments so that you get the best possible health, wealth and leisure options.

Essentially that means you spend the maximum amount on important things and cut down your expenditure on non-essential things.

So get ready to buy the best quality, and if needed most expensive food, safety, house, and transportation options and impose a limit on impulse purchases in the mall, junk food, etc.

In one sentence, a good budget is all about prioritizing your spending habits on what’s important to you and your family.

Is the Budget about Saving money too?

Of course. It’s as important to save money for emergencies and future requirements as it is to spend it on the best options money can buy today.

Many financial pundits recommend you set aside a percentage of your income as savings as soon as you receive your paycheck. And only then you should even start thinking about spending.

This is great advice. And if you try to follow the ideal budget percentages for a few months you’ll know how much percentage of your income you need to/are able to set aside each month.

Why is Housing the largest chunk of the Ideal Budget?

The housing budget mentioned here is not the rental money. It’s the housing loan repayment money.

Let’s admit it – for most people, the largest expenditure is related to housing. If you are going to live in rented properties, a large portion of your income is wasted. So it’s very important to somehow adjust your lifestyle and buy a home through a home loan – as soon as possible.

Own housing is one of the best investments you can make and hence it forms the largest chunk of the ideal budget calculations.

Why is charitable gifts even there on this Ideal Budget list?

Responsible and happy citizens always budget a small portion of their income to charitable causes they believe in. However, the percentage indicated here is based on others’ spending averages and it can be a lower value as well if you have other pressing requirements currently.