Impact of Inflation on Savings & Smart Tips to Beat Inflation

Are you aware of the Impact of Inflation on Savings? In other words, are you aware that the purchase power of the money in your savings account, although growing through interest received from bank savings or CDs, may actually be shrinking due to an inflation rate that’s higher than your rate of interest?

The impact of inflation on savings is an important factor that people generally don’t consider. In this blog post, I will tell you why you should and what unconventional techniques I am using to beat inflation, especially post-COVID.

What is Inflation?

In simple words, inflation is the percentage of price-rice of all goods, calculated over a specific period – eg. annually. If you were able to buy a product for $100 USD last year, and the same product costs $103 USD this year, the price increase is attributed to inflation. Refer to this article for more details on how to calculate inflation.

The Impact of Inflation on Savings

If you had invested $100 USD in your Savings account last year, your account balance would have grown to $102 USD this year (assuming a 2% annual interest). But, during the same period, if the inflation is 3% (for example), you are at a loss because the same product costs $1 USD more than what you have in your savings account.

The purchasing power of your money has decreased in one year, in spite of the interest you received in your savings bank account. The longer you keep your money in the savings account, the more is your loss assuming that the savings interest rate is lower than the rate of inflation. Generally it is.

On top of inflation, since the savings bank interest is taxed, you also need to account for taxes before you calculate the change in purchase value of your money over a period.

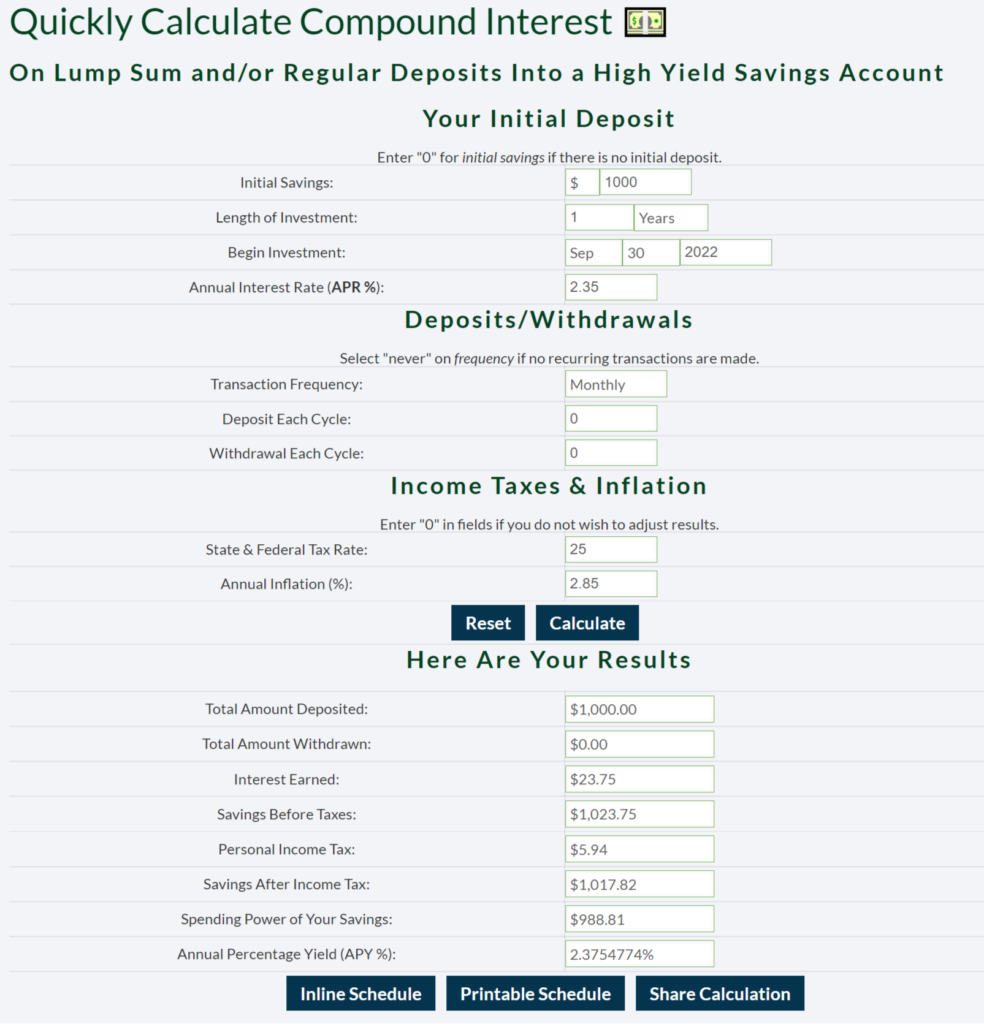

Here is a Savings Calculator that’ll enable you to quickly calculate compound interest on lumpsum or regular deposits into a savings account. You can calculate the new value of your savings after accounting for inflation and taxes.

Here is a sample calculation I made with a deposit amount of $1000 USD and a savings term of one year –

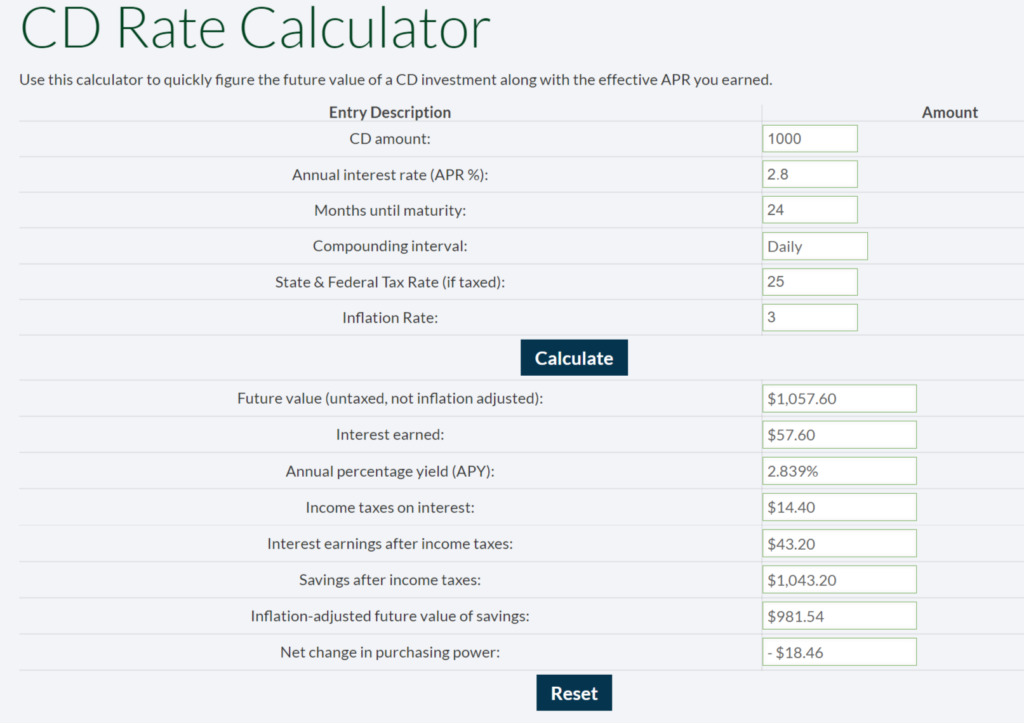

CDs can give you a higher return if you can lock your investments over a specified period of time. Here is a CD Rate Calculator that enables you to calculate the effective value of your savings after adjusting for inflation and taxes. Eg.

As you can see in the above two examples, the spending power of my money – through inflation and tax-adjusted future value of my savings, has decreased.

What did I do to cut my losses due to Inflation?

The first important thing is to become aware and acknowledge that inflation is eating away at your savings. Once I acknowledged that to myself, I started to look at ways to compensate for the losses on my savings I incurred due to inflation.

There are two ways to approach this issue –

- Build a wider (and riskier) savings portfolio to get higher returns on investments

- Reduce my cost of Living

If you are comfortable investing in riskier investments that give higher returns, like mutual funds, the stock market, gold, real estate, etc., go ahead. Almost everyone suggests only this, and there are tons of resources on the Internet on how to invest better to beat inflation.

But in this post, I want to focus on the second aspect that no one talks about – reducing the cost of living. A dollar saved is a dollar earned – right? Let’s see how I reduced my cost of living.

First, I recorded all my income and expenses over a month in an excel sheet. Since I am self-employed, I had a vague idea of either. Once I started writing this info daily, I had a better view of my financial situation at the end of a month.

I now could clearly see all my wasteful expenditures.

I was buying software and product deals that I didn’t want or use. I noticed I was eating out or ordering fast food frequently, which became a major expenditure. We were also going to the cinema very frequently – the cost of transportation, tickets, and the eatables we purchased there added up quickly.

So I decided to cut these discretionary expenses as much as possible.

- I stopped buying software deals altogether, and I bought products only when I needed them – not when they advertised limited-time deals for them.

- I decided to eat out once a week and strictly kept that schedule.

- We stopped going to movie halls and bought an LED projector, good speakers, and a large screen. Now I can watch more movies anytime through OTT/Movie streaming services from the comfort of my home.

I saved around 20% of my income by doing these three simple things. If you note down and cut your wasteful expenditure, I am sure you can save more.

This proves that, besides investing smartly, it’s important to reduce our cost of living to beat the losses due to inflation comfortably.