5 Easy Ways to Save Money: Money Saved = Money Earned

One of the best ways to make money work for you is to save money and let it earn interest quietly. And, reinvesting that interest amount will also earn more interest for you, thereby compounding the amount you save.

In this post, I will discuss some easy ways in which you can save money and invest that money to earn interest over time. These saving tips are simple but you might not have considered them yet. More importantly, I will also show the proof by giving you the amount of money you can save by implementing each of my ideas. Yes, it helps to quantify – to actually see the amount of money you can save implementing these tips.

Guess what, you’ll be surprised about how much you can earn by just following these simple tips for saving money.

After all, Money Saved = Money Earned, right? That’s the easiest way to beat inflation.

#1. Buy Generic Products instead of Branded Ones

If there is a real qualitative benefit to buying a branded product over a generic one, by all means, you should buy the branded product.

But in many cases, the benefit is just perceptive. For example, if you buy branded clothes over less-known or generic ones, or if you buy an iPhone over Android, you are mostly paying more for the brand name, not any real benefit. At least, not the benefit that justifies the huge price difference.

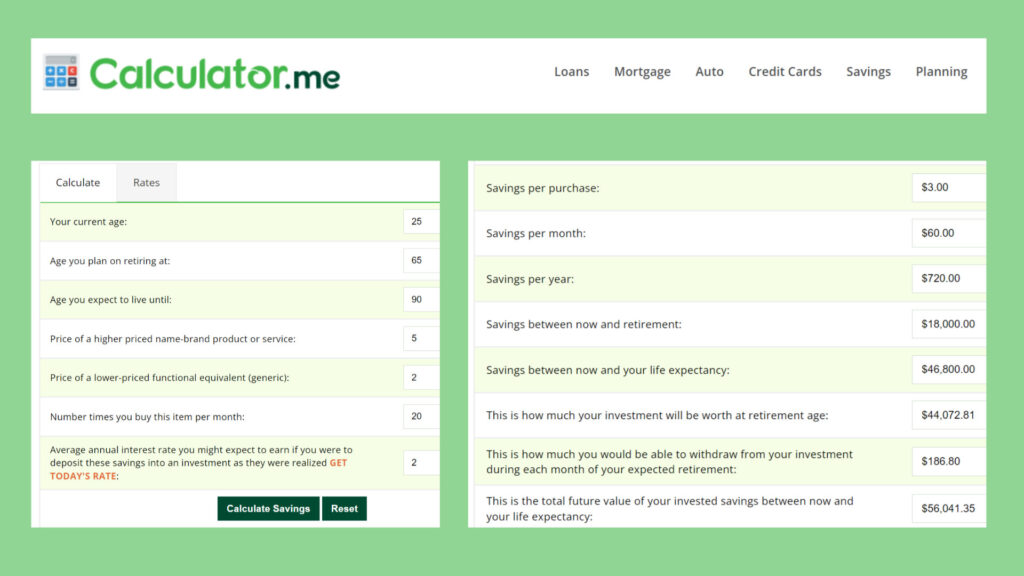

Let’s consider the example of buying a small branded grocery item worth $5 instead of a generic one at $2. At first glance, the amount doesn’t seem big. But if you consider that you’ll be buying it repeatedly every month, and every year, the amount of money you waste adds to a huge sum. Here is the calculation as per calculator.me savings calculator,

Although the savings per purchase is just $3, the savings per year could be as much as $720 for just one item. Imagine how much you could save with multiple items over many years!

#2. Plug Off Unused Electrical Appliances

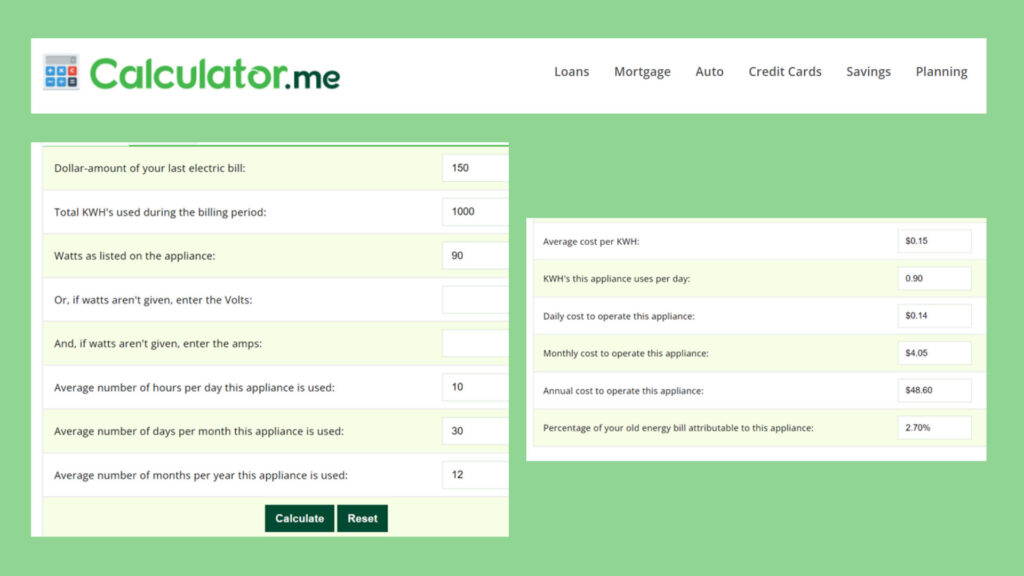

All of us have this habit of switching off the TV or putting the Laptop to sleep after usage, but we forget to unplug it (or) switch off the main electric switch it’s plugged into. We might not think these devices consume much power when they sleep, but they do. Consider the following example of a 90W laptop that’s put to sleep but plugged in, according to calculator.me appliance operating costs calculator –

That $4.05 per month savings due to unplugging one device doesn’t look big, but when you unplug multiple appliances after usage, the savings over a year or multiple years will be considerable.

#3. Reduce Opportunity Spending Costs

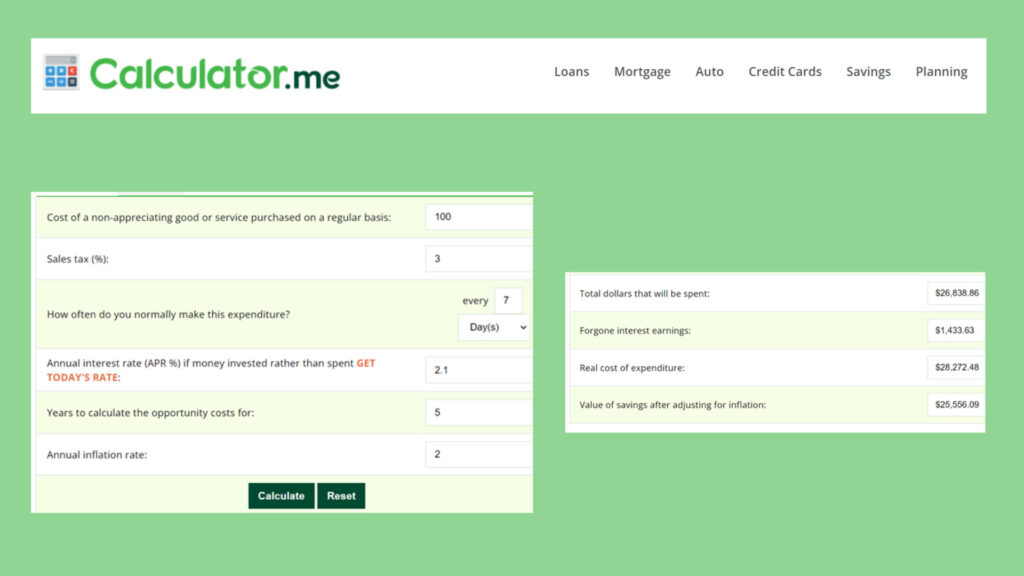

Going to a movie once a week may not seem like a huge expenditure. But the costs quickly add up and so does the interest amount you’d have gained had you invested that money in a bank.

If you spend $100 watching a movie over the weekend, can you guess how much you will lose at the end of 5 years? That’s $28,272, including the interest, as per calculator.me’s periodic spending cost calculator,

Now, that’s a lot of money don’t you think? Instead, if you subscribe to the popular OTT platforms and watch movies over the net, you can save a lot of money and time. Maybe you can set up a basic home theater at home to enhance the movie-watching experience.

Imagine how much more you’d lose for other opportunity costs like cigarettes, luxury perfumes/soaps, etc. Opportunity costs need not just be small recurring amounts, it could also be a huge one-time spend, like buying an iPhone – for example. To calculate the lost opportunity cost due to one-time spending, refer to this calculator.

#4. Cook and Bring Lunch from Home

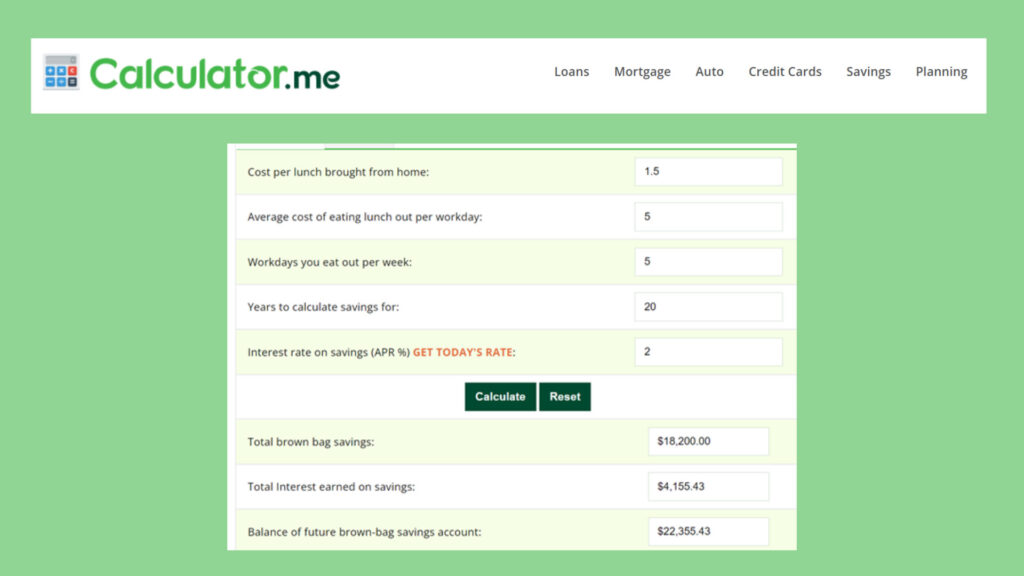

Cooking your own lunch & bringing it to the workplace not only saves a lot of money in the long run but also enhances your health. Both cooking & eating improve your well-being when compared to eating meals at a restaurant.

Have a look at the above numbers from calculator.me’s Brown Bag Savings Calculator. If you spend $5 per day on eating out, cooking your own lunch would cost you just $1.5. In the long run (20 years in this example), you’ll save a whopping $22,355. Besides, cooking is also a great exercise & stress buster.

#5. Rightsize your Meat Buying

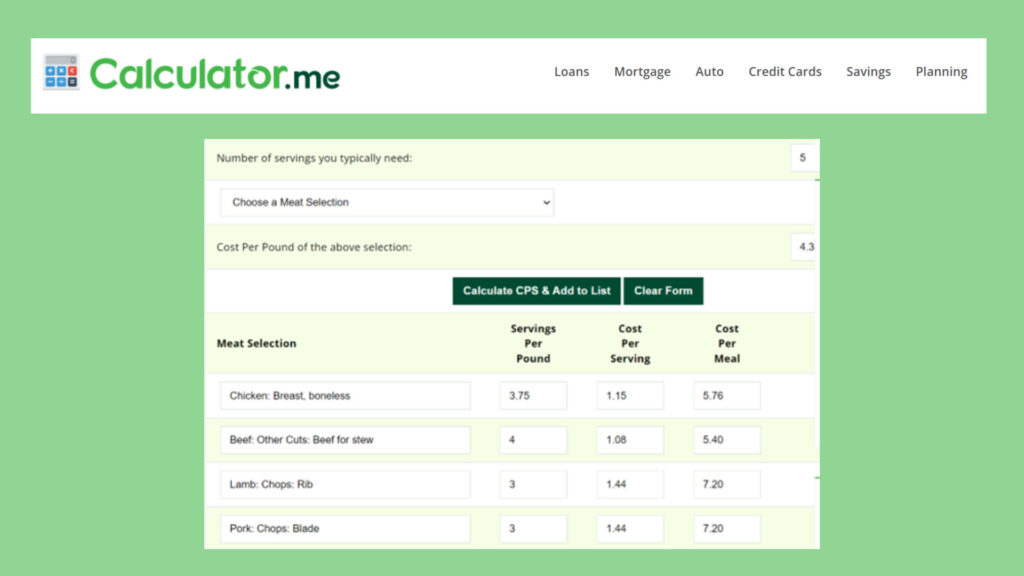

One pound of meat will not yield the same number of servings for all cuts of meat. Hence, instead of focusing on cost per pound, you ought to focus on cost per serving.

In this calculator.me Meat Serving Cost Calculator, if you enter the number of servings you typically need and choose different meat selections, it will give you the Servings per Pound and Cost per Servings data for all your selections. Here is an example,

This calculator can be very useful to rightsize your meat purchases and save a lot of money in the long run.

If you calculate the amount of money you can save, you’ll be inspired to implement these five simple saving tips.